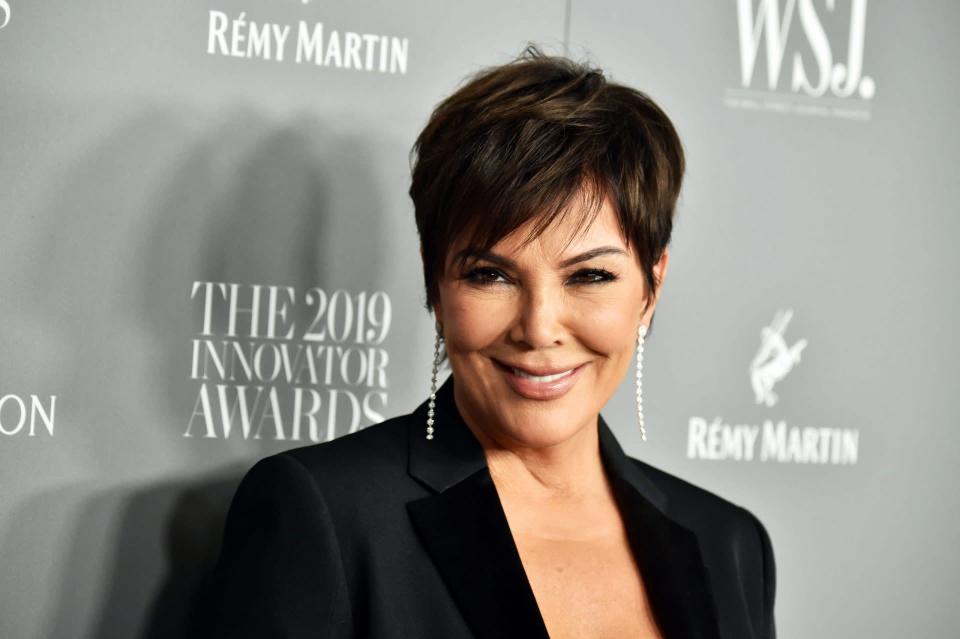

Price Is Right Logo Kris Jenner Funny Face

- Finance

- Watchlists

- My Portfolio

- Cryptocurrencies

- Yahoo Finance Plus

- Screeners

- Markets

- Options: Highest Open InterestOptions: Highest Open Interest

- Options: Highest Implied VolatilityOptions: Highest Implied Volatility

-

- News

- Personal Finance

- Videos

- Influencers with Andy SerwerInfluencers with Andy Serwer

- Yahoo Finance All Markets SummitYahoo Finance All Markets Summit

- America: Back in BusinessAmerica: Back in Business

-

- Yahoo U

- Industries

- Tech

- Contact Us

-

S&P Futures

-

Dow Futures

-

Nasdaq Futures

-

Russell 2000 Futures

-

Crude Oil

-

Gold

-

Silver

-

EUR/USD

-

10-Yr Bond

-

Vix

-

GBP/USD

-

USD/JPY

-

BTC-USD

-

CMC Crypto 200

-

FTSE 100

-

Nikkei 225

-

-

-

-

Here's how much the average working boomer has saved for retirement

Three news items that say a lot about the retirement crisis facing Americans and what we can do about it—if we want to. The first is a survey of 1,000 working Americans conducted recently showing much, or little, they have saved for retirement. Less than half of those surveyed have saved $100,000: Not even close to enough to support a median income of around $40,000 a year in retirement.

-

-

Berkshire Hathaway buys 9.6 million more Occidental shares, raises stake to over 16%

The purchases were made over the past week and cost about $529 million, Berkshire said in a regulatory filing on Wednesday. Following the purchases, Berkshire now owns about 152.7 million Occidental shares worth about $8.52 billion based on Occidental stock's Wednesday close, which is down over 21% since it touched its year's high in May. However, Occidental's share prices are currently up over 90% this year, after more than doubling, as they benefited from Berkshire's purchases and rising oil prices following Russia's invasion of Ukraine.

-

Abby Joseph Cohen Says Era of Everything Going Up Is Over

(Bloomberg) -- With fervor in markets receding, investors will need to critically focus on fundamentals and security selection to ride out the turbulence, Abby Joseph Cohen said.Most Read from BloombergThe World's Bubbliest Housing Markets Are Flashing Warning SignsJuul Soon to Be Ordered Off the Market by FDA, WSJ ReportsSwitzerland Imports Russian Gold for First Time Since WarStocks Snap Rally as Recession Fears Mount: Markets WrapPowell Says Soft Landing 'Very Challenging;' Recession Possible

-

Seeking at Least 8% Dividend Yield? Analysts Suggest 2 Dividend Stocks to Buy

With gasoline prices through the roof at record highs, inflation running at 40-year record levels, and last year's bullish stock market turn down into a genuine bear, it's no wonder that the financial and economic worlds are looking like reruns of 'That 70s Show.' Market watchers remember that the bad times of the late 70s and early 80s were tamed only when Fed Chair Paul Volker sparked a recession with near-20% interest rates – and for investors under 45, just take note that Q1 this year saw a

-

Deep rift lies behind Biden's criticism of oil and gas industry

U.S. President Joe Biden has publicly criticized oil and gas executives for banking big profits from high gasoline prices but he has rarely spoken directly to the heads of energy companies or their representatives, White House records and interviews with industry sources show. Biden said at a labor union event this month that Exxon Mobil Corp "made more money than God this year" and sent a letter to seven oil and gas companies calling on them to increase production to help ease the burden on consumers. His actual engagement with energy company officials is rare, however, according to the industry sources and records, a marked contrast to Biden's meetings with top executives in retail, logistics and agriculture, as the government grapples with inflation at a 40-year high and supply chain snarls.

-

Retirement accounts pummeled as a result of market volatility

Yahoo Finance's Kerry Hannon details the decline in retirement accounts amid recent market volatility as people seeking to retire aim to minimize impacts on 401(k) returns, in addition to how millennials are approaching retirement and Social Security savings.

-

Bitcoin Is Leading Indicator of Stock-Market Bottom, Mobius Says

(Bloomberg) -- If you're a stock trader, you should probably be turning your attention to cryptocurrencies right about now.Most Read from BloombergThe World's Bubbliest Housing Markets Are Flashing Warning SignsSwitzerland Imports Russian Gold for First Time Since WarThe Supreme Court Has Just Eroded First Amendment LawLiz Cheney Is Paying the Price in Her Home State for Crossing TrumpStocks Rise as Powell Seen as 'Less Hawkish': Markets WrapThat's according to Mark Mobius, who co-founded Mobius

-

U.S. tech companies yank job offers, leaving college grads scrambling

One by one, over the last week of May, Twitter Inc rang up some members of its incoming class of new hires who had recently graduated from college and revoked the job offers in 15-minute calls, according to some of the recipients. "It was traumatic," Iris Guo, an incoming associate product manager living in Toronto, told Reuters. More than 21,500 tech workers in the United States have lost their jobs so far this year, according to Layoffs.fyi, a website that monitors job cuts.

phillipspreempory.blogspot.com

Source: https://finance.yahoo.com/news/much-kris-jenner-worth-220001156.html

0 Response to "Price Is Right Logo Kris Jenner Funny Face"

Post a Comment